Trading bots, powered by algorithms and artificial intelligence, can execute trades based on predefined rules and strategies, eliminating human emotions and improving efficiency. We will walk you through the process of building your own trading bot from scratch. Whether you’re a seasoned trader looking to automate your strategies or a beginner interested in exploring algorithmic trading, this guide will provide you with the knowledge and tools to get started.

Comprehension Trading Bot Software

Trading bot software refers to computer programs that execute trading strategies automatically based on predefined rules. These bots can analyze market data, identify trading opportunities, and execute trades without human intervention. Trading bots can be designed for various financial markets, including stocks, cryptocurrencies, forex, and commodities.

Benefits of Using Trading Bot Software

Trading bot software offers several advantages to traders:

- Automation: Trading bots can execute trades 24/7, even when you’re away from your computer, allowing you to take advantage of market opportunities at any time.

- Speed and Efficiency: Bots can analyze market data and execute trades much faster than human traders, reducing latency and improving trade execution.

- Emotion-Free Trading: Bots follow predefined rules and strategies without emotions, eliminating the influence of fear, greed, or other psychological factors that can impact human traders.

- Backtesting and Optimization: Trading bots can be backtested using historical data to evaluate their performance and optimize strategies for better results.

- Diversification: Bots can handle multiple trading strategies and assets simultaneously, allowing for better diversification and risk management.

- Discipline and Consistency: Bots strictly adhere to predefined rules, ensuring consistent execution of trading strategies and avoiding impulsive decisions.

Planning Your Trading Bot

Planning your trading bot is a crucial step in the development process. It involves defining your objectives, selecting the right trading instruments, determining your risk tolerance, setting a timeframe, and identifying the data requirements for your strategies. By carefully planning these aspects, you lay a strong foundation for the success of your trading bot.

Firstly, you need to clearly define your objectives. Are you aiming for short-term profits through day trading, or do you prefer long-term investments? Understanding your goals will help you design the appropriate strategies and trading parameters. Additionally, selecting the trading instruments is important. Decide whether you want your bot to trade stocks, cryptocurrencies, forex, or other assets. Each market has its own characteristics and requires specific strategies. Assess your risk tolerance and establish risk management rules to protect your capital. Determine how much you are willing to risk per trade and set stop-loss levels accordingly. It’s also crucial to define the timeframe for your trading bot. Will it operate on a daily basis, making trades at specific times, or will it work on shorter timeframes, executing trades more frequently? Lastly, identify the types of market data you need, such as historical price data, order book data, or news sentiment data, to inform your trading strategies. By thoroughly planning these aspects, you set yourself up for a more successful and efficient trading bot.

Choosing the Right Programming Language

Choosing the right programming language is crucial for developing your trading bot. Here are some popular choices:

- Python: Python is widely used in algorithmic trading due to its simplicity and extensive libraries such as Pandas and NumPy for data analysis.

- Java: Java offers high performance and is often preferred for building low-latency trading systems.

- C++: C++ provides excellent performance and is suitable for building high-frequency trading bots.

- R: R is popular among quantitative analysts and provides extensive statistical and data analysis capabilities.

Collecting and Analyzing Market Data

Collecting and analyzing market data is a vital part of building a trading bot. Access to accurate and timely data is essential for making informed trading decisions. There are several methods and techniques you can employ to collect and analyze market data effectively.

One common approach is to utilize APIs provided by exchanges and financial data providers. These APIs allow you to programmatically fetch real-time and historical market data. By leveraging these APIs, you can access a wealth of information such as price data, trading volume, order book data, and more. It’s important to select reliable and reputable data sources to ensure the quality and accuracy of the data you receive.

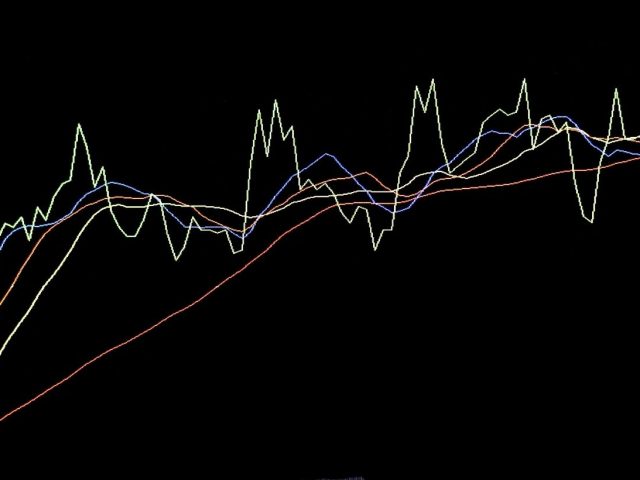

Once you have obtained the market data, the next step is to clean and preprocess it. Market data can often contain inconsistencies, missing values, or outliers that may affect the integrity of your analysis. Cleaning and preprocessing involve techniques such as data normalization, removing duplicates, handling missing values, and identifying and addressing outliers. By ensuring the cleanliness and quality of the data, you can proceed to analyze it effectively. This may involve applying various statistical and technical analysis methods, such as calculating moving averages, identifying trends, or utilizing popular indicators like Bollinger Bands or Relative Strength Index (RSI). Analyzing market data allows you to gain insights and make data-driven decisions when designing and implementing your trading strategies.

Implementing Trading Strategies

Trading strategies form the heart of your trading bot. Here are some common strategies you can implement:

- Moving Average Crossover: Buy when a shorter-term moving average crosses above a longer-term moving average, and sell when it crosses below.

- Mean Reversion: Identify assets that have deviated significantly from their mean value and bet on them reverting to the mean.

- Breakout Trading: Take positions when the price breaks out of a defined range, expecting the price to continue moving in the breakout direction.

- Arbitrage: Exploit price differences between different exchanges or trading pairs to make risk-free profits.

Setting Up API Connections

To interact with exchanges and execute trades programmatically, you need to set up API connections. Here’s what you need to do:

- Register on Exchanges: Create accounts on the exchanges you want to trade on and obtain API keys.

- API Authentication: Authenticate your API requests using the provided API keys.

- Order Execution: Utilize the exchange APIs to place buy/sell orders and monitor order status.

Risk Management in Trading Bots

Effective risk management is crucial in trading bot development. Here are some risk management techniques to consider:

- Position Sizing: Determine the appropriate position size for each trade based on your risk tolerance and account balance.

- Stop Loss and Take Profit: Set predefined stop-loss and take-profit levels to limit losses and secure profits.

- Portfolio Diversification: Allocate your capital across multiple assets or trading strategies to reduce overall risk.

- Monitoring and Adjustments: Regularly monitor your bot’s performance and adjust risk parameters if necessary.

Leave a Reply